Wealth Management Resources

Your trust can also outlive you, continuing for the support of your dependents without normal probate delays or publicity. Usually, a living trust helps to limit estate settlement expenses and can be drafted to save taxes upon the death of your surviving spouse and/or beneficiaries.

Your instructions are set forth in a written trust agreement, drawn by your attorney, and you retain the right to alter or terminate the agreement during your lifetime.

A living trust arrangement with Trustco Bank affords you all the benefits of our trust services, as well as future self-protection.

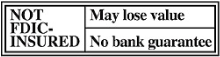

Non-deposit investment products.